A cash flow hedge may be designated for a highly probable forecasted transaction a firm commitment not recorded on the balance sheet foreign currency cash flows of a recognized asset or liability or a forecasted intercompany transaction. In this report we survey firms reporting practices and examine hedges and hedge accounting generally and seek to determine why firms may decide not to designate derivatives as hedges for accounting purposes.

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

Non-derivative financial instruments measured at.

. What can be designated as hedging instruments. Donors to a nonprofit organization may designateor restrictthe use of their donations to a particular purpose or project. Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by Agent has been designated as a Designated Hedge Agreement so that such Credit Partys counterpartys credit exposure.

If a component of the cash flows of a financial or a non-financial item is designated as the hedged item that component must be less than or equal to the total cash flows of the entire item. Designated Vs Non Designated Hedge. Therefore Entity A qualifies to use the shortcut method.

An example is a gift to a special scholarship fund at a university. If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply. What Are the Nonprofit Fund Types.

Entity A has designated the swap as a hedge of the changes in fair value of the fixed-rate note due to changes in the designated benchmark interest rate and Libor as the benchmark rate risk being hedged. Hedging with forward contracts 16 46. Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any of its Subsidiaries is a party and as to which a Lender or any of its Affiliates is a counterparty that pursuant to a written instrument signed by the Administrative Agent has been designated as a Designated Hedge Agreement so that the.

We would like to show you a description here but the site wont allow us. Derivative financial instruments 15 42. A fair value hedge may be designated for a firm commitment not recorded or foreign currency cash flows of a recognized asset or.

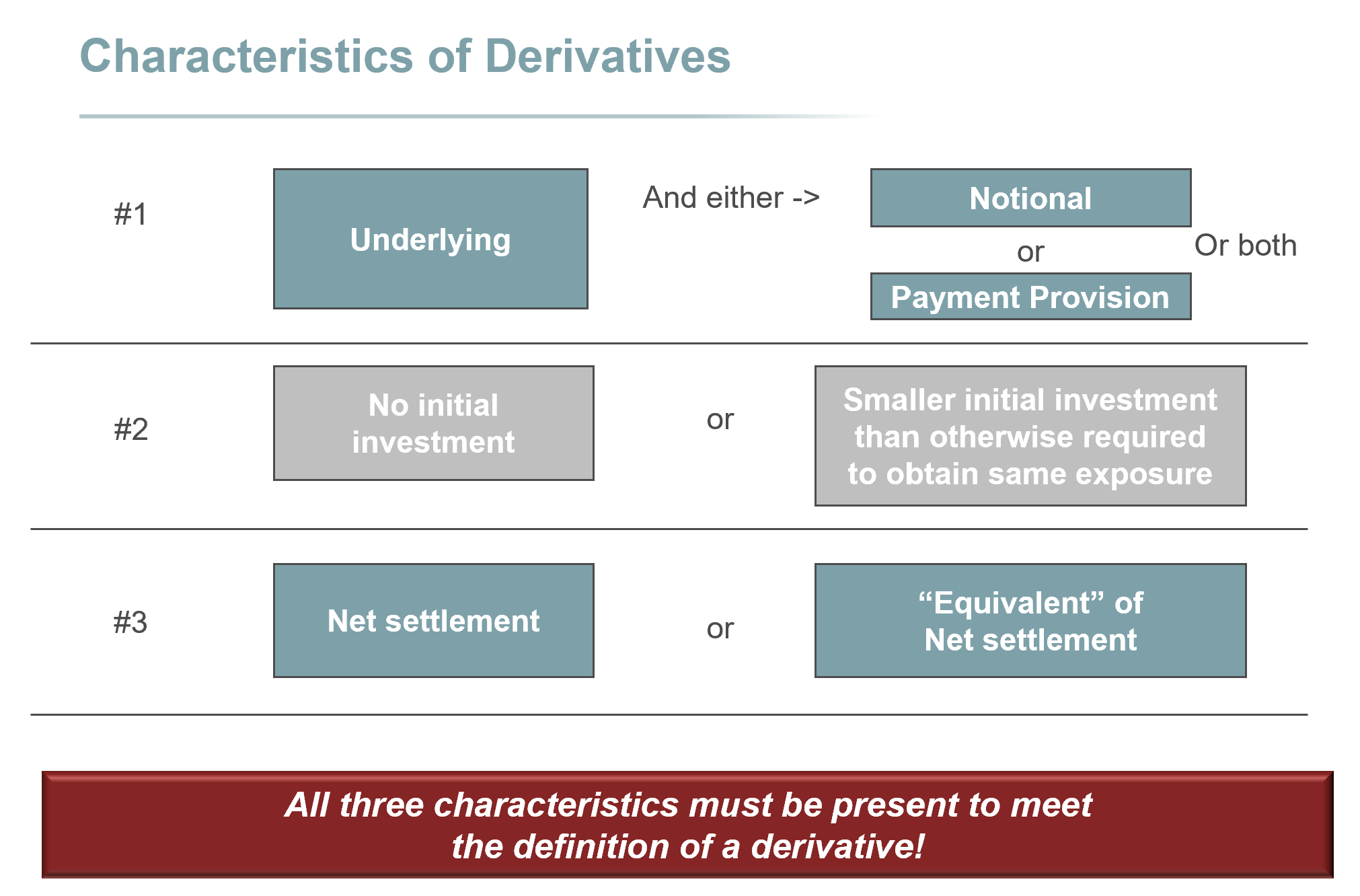

Embedded derivatives 15 44. Under IFRS 9 risk components of financial items such as the SONIA rate replacement of LIBOR rate in a loan that bears interest at a floating rate of SONIA plus a spread could be designated as a hedged item provided they are separately identifiable and reliably measurable and risk components can be designated for non-financial hedged items provided. Under normal accounting we would still affect PL with the net amount.

The Disclosure also explains the difference between a Designated Agency and a Non-Designated Agency. Derivatives not designated as hedges are recognized initially at fair value and attributable transaction costs are recognized in net profit in the Consolidated Statement of. Designated vs non designated hedge Purity encouraged nail art with white coronary heart shapes within the nail strategies easy nonetheless exquisiteShades of white and silver beads are preferred simply because they can certainly match your outfit regardless of what situation it may be.

And ongoing monitoring of. Any derivative that is either not designated as hedge or is so designated but is ineffective as per Ind AS 109 is categorized as a financial asset or financial liability at fair value through profit or loss. I have Designated son and Non-Designated Beneficiaries 3 charities to my traditional IRA.

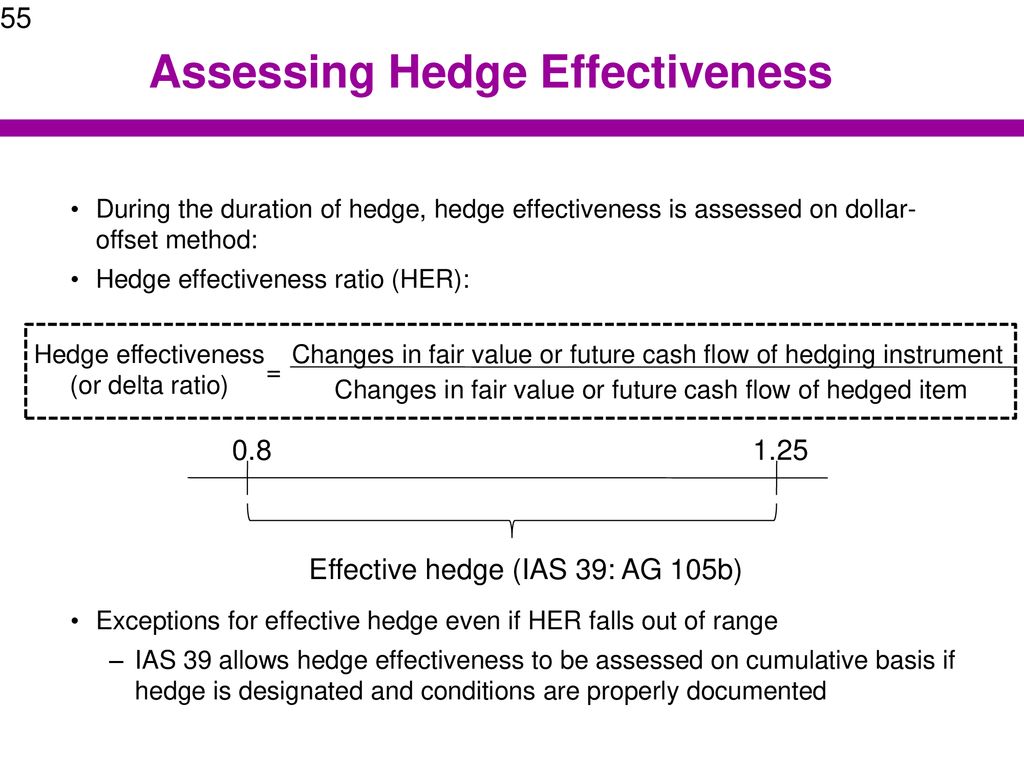

This assessment encompasses operational aspects such as the hedge effectiveness test as well as the eligibility of items such as risk components of non-financial items that can be designated in hedging relationships. Designated Fair value hedge. Non-designated heritage assets in Conservation Areas.

The gain or loss on a derivative instrument not designated a hedging instrument appears in current income. Unrestricted funds are donations the nonprofit may use for any purpose. Non-derivative financial instruments measured at fair value through PL 15 43.

Clear identification as a hedge before the close of the day on which the taxpayer acquired originated or entered into the transaction is required Regs. Hedge accounting has not been achi eved in the past. This is a very important distinction to understand before you make the decision to become a Client of the Agent andor Agency.

A recent Court Judgment has brought some additional and important clarification on how non-designated heritage assets NDHAs in Conservation Areas should be dealt with in the context of planning decisions. A Non-Designated Agency real estate firm owes a duty of loyalty to a client which is shared by all agents of the firm. However all of the cash flows of the entire item may be designated.

The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. Accounting for currency basis spreads 17 5. This is a hedge of the fair value of an asset or liability in a purchase sale transaction or firm commitment at a definite price.

The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. Designated Vs Non Designated Hedge. IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met except for some written options.

For financial entities the situation is more complex. IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met except for some written options. This rule is relaxed by Regs.

11221-2 f 2 ii which states that the identification must be made substantially contemporaneously. The Dorothy Bohm v SSCLG 2017 EWHC 3217 Judgment clarifies that just because. 2 What would be the difference if we apply hedge accounting and if we do not apply hedge accounting because I cant see a difference ie under hedge accounting the net amount between what we pay and what we receive will go to PL basically the non-effective portion.

Hedging with purchased options 15 45.

Selisih Kurs Derivatif Dan Hedging Ppt Download

Derivatives Including Hedging Ppt Download

Derivatives And Hedging Gaap Dynamics

Module Derivatives And Related Accounting Issues Derivatives Derivatives

We Decided To Help People Stay Within The Designated Area By Making A Lovely Hedge Using Pretty Tea Olives Vinca Olive Trees Landscape Patio And Garden Plants

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

Solved Understanding Derivative Instruments 1 What Is Chegg Com

0 comments

Post a Comment